All Categories

Featured

Table of Contents

According to SEC officials, existing CDAs have actually been registered as safety and securities with SEC, and as a result are covered by both government securities regulations and guidelines, and state insurance policy laws. At the state level, NAIC has created state disclosure and suitability policies for annuity products. States vary on the extent to which they have adopted these annuity guidelines, and some do not have protections at all.

NAIC and state regulatory authorities told GAO that they are presently assessing the guidelines of CDAs (best annuity plan). In March 2012, NAIC started reviewing existing annuity regulations to determine whether any type of adjustments are required to address the special product style functions of CDAs, consisting of prospective modifications to annuity disclosure and suitability criteria. It is likewise examining what sort of funding and scheduling needs might be required to help insurers take care of item threat

Income Annuities For Retirement

Both agree that each state will have to reach its own conclusion concerning whether their certain state guaranty fund laws enable for CDA coverage. Until these governing concerns are settled, customers may not be totally protected. As older Americans retire, they may face increasing health care expenses, rising cost of living, and the threat of outliving their possessions.

Life time earnings items can aid older Americans guarantee they have revenue throughout their retirement. VA/GLWBs and CDAs, two such items, might provide special advantages to customers. According to industry individuals, while annuities with GLWBs have actually been marketed for a variety of years, CDAs are reasonably new and are not widely offered.

GAO gave a draft of this record to NAIC and SEC (annuity agents). Both offered technical remarks, which have actually been addressed in the record, as suitable. To learn more, get in touch with Alicia Puente Cackley at (202) 512-8678 or

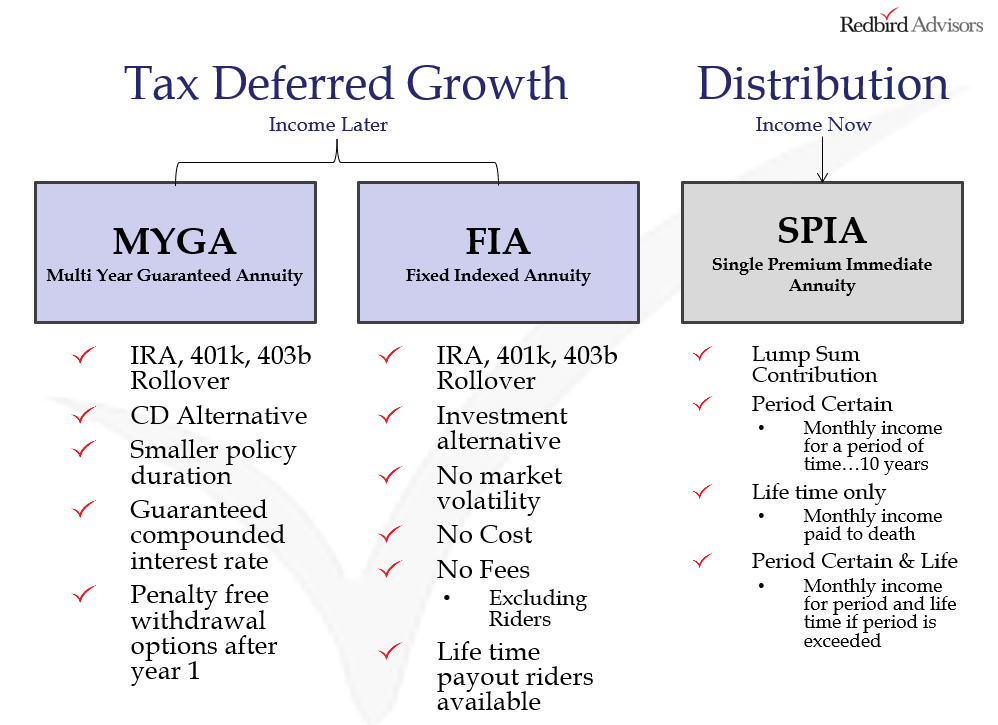

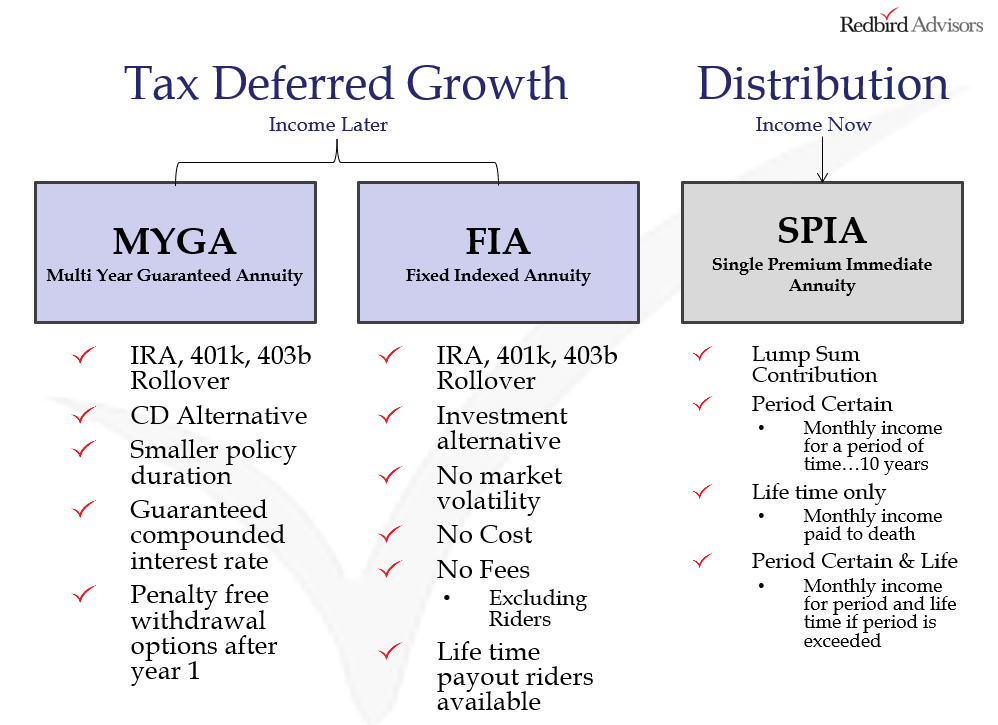

It guarantees a set passion rate yearly, no matter of what the securities market or bond market does. Annuity guarantees are backed by the financial strength and claims-paying capacity of American Financial savings Life Insurance Policy Business. Security from market volatility Assured minimal rate of interest Tax-deferred cash money buildup Ability to prevent probate by marking a beneficiary Option to turn part or every one of your annuity right into an earnings stream that you can never ever outlive (annuitization) Our MYGA provides the very best of both worlds by ensuring you never shed a dollar of your primary financial investment while at the same time guaranteeing a rate of interest for the chosen amount of time, and a 3.00% guaranteed minimum rate of interest for the life of the contract.

The rates of interest is guaranteed for those surrender charge years that you choose. We are able to pay above-market rate of interest prices due to our below-average overhead and sales expenditures in addition to our consistent above-average monetary performance. 1-Year MYGA 5.00% 2-Year MYGA 5.25% 3-Year MYGA 5.25% 4-Year MYGA 5.25% 5-Year MYGA 5.25% 10% Annual Penalty-Free Withdrawal Biker (no charge) Penalty-Free Survivor benefit Biker (no price) Penalty-Free Chronic Health Problem Rider (no charge) Penalty-Free Terminal Illness Rider (no charge) Penalty-Free Nursing Home Arrest Cyclist (no charge) Multi-Year Guaranteed AnnuityAn Person Solitary Costs Fixed Deferred Annuity Passion Rate Options(Rates of interest differ by thenumber of years selected) 1-Year: 1-year surrender charge2-Years: 2-years abandonment charge3-Years: 3-years give up charge4-Years: 4-years give up charge5-Years: 5-years surrender fee Problem Ages 18-95 years of ages: 1 or 2 years durations18-90 years of ages: 3, 4, or 5 years durations Problem Age Decision Current Age/ Last Birthday Minimum Premium $25,000 Maximum Costs $500,000 per individual Rate Lock Allocations For situations such as IRA transfers and IRC Section 1035 exchanges, an allowance might be made to lock-in the application date interest rateor pay a greater rate of interest that may be readily available at the time of issue.

Rates reliable since November 1, 2024, and undergo alter without notice. Withdrawals are subject to common revenue tax obligations, and if taken prior to age 59-1/2 may incur an extra 10% federal penalty. Early abandonments might result in receipt of less than the original premium. spia annuity rates. Neither American Cost Savings Life neither its producers provide tax or lawful advice.

Annuity Carriers

These payout prices, which include both interest and return principal. The rates represent the annualized payment as percent of total costs. The New York Life Clear Revenue Benefit Fixed AnnuityFP Collection, a set deferred annuity with a Surefire Lifetime Withdrawal Benefit (GLWB) Biker, is issued by New York Life Insurance Policy and Annuity Corporation (NYLIAC) (A Delaware Company), a wholly owned subsidiary of New York Life Insurance Business, 51 Madison Opportunity, New York, NY 10010.

All guarantees depend on the claims-paying capacity of NYLIAC. Products offered in authorized territories. There is a yearly motorcyclist fee of 0.95% of the Accumulation Worth that is subtracted quarterly - cost of an annuity. * These figures are efficient since date and are subject to alter at any kind of time. Based upon the life with money reimbursement alternative, male annuitant with $100,000.

An ensured annuity rate (GAR) is an assurance by your pension plan carrier to give you a certain annuity price when you retire.

Compare Fixed Annuity Rates

, which can also offer you a far better rate than you 'd usually get. And your ensured annuity might not consist of features that are important to you. what is an annuity period.

A guaranteed annuity price is the rate that you get when you purchase an ensured annuity from your carrier. This influences just how much revenue you'll get from your annuity when you retire. It's great to have actually an ensured annuity price since maybe a lot greater than existing market prices.

Surefire annuity prices can go as high as 12%. That's about dual the most effective rates you'll see on the marketplace today. So (unless you qualify for an boosted annuity) you could get twice the earnings you 'd receive from a non-guaranteed annuity rate annuity. You can lose your ensured annuity price if you change to one more sort of pension plan (what are pension annuities) or a various annuity carrier.

What Is Retirement Annuities

If you select to transfer to a flexi-access pension plan, you might require to talk to a financial consultant. There might also be limitations on when you can establish up your annuity and take your assured price.

It's an information that often obtains buried in the fine print. interest rate on annuities. Your provider might call it something like a 'retirement annuity contract', or describe a 'Area 226 plan', or simply speak regarding 'with-profits', 'advantages', 'advantageous' or 'assure' annuities. So to locate out if you've obtained one, the most effective thing to do is to either ask your supplier straight or examine with your economic adviser.

This is a death benefit choice that changes your annuity repayments to a liked one (usually a partner) for a certain quantity of time up to 30 years - when you die. An annuity assurance period will offer you tranquility of mind, yet it also indicates that your annuity income will certainly be a little smaller.

If you select to transfer to one more carrier, you might lose your ensured annuity rate and the benefits that come with it. Yes - annuities can come with a number of different kinds of warranty.

Today's Annuity Rates

As you can visualize, it's easy to mention an ensured annuity or a guaranteed annuity price, implying a surefire income or annuity assurance duration. Assured annuity prices are really very various from them.

Table of Contents

Latest Posts

Breaking Down Your Investment Choices A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Choosing the Right Financial Stra

Highlighting Fixed Index Annuity Vs Variable Annuity Everything You Need to Know About Fixed Index Annuity Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Dif

Analyzing Strategic Retirement Planning Everything You Need to Know About Deferred Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Annuity Vs Equity-lin

More

Latest Posts